The civil construction space in New Zealand is of great importance to the economic and social prosperity of the country. With the dynamic shifts in years from environmental, social, and government forces, we began partnering with Civil Contractors New Zealand (CCNZ) and created a survey to gauge perspectives of industry leaders. Since 2016, we’ve continued to deliver the annual report and have highlighted the key findings in detail at each CCNZ annual conference to drive positive awareness and change.

Now in its nineth year, the survey is revealed at a panel alongside industry figureheads, to reveal genuine insight into how the industry is fairing. The report, which you can download, compares data in many key insights from 2020, giving a great 5-year insight into sentiment and highlights some key verbatim from respondents into the main challenges and thoughts on how they could be overcome.

Download the 2025 CIS report here >

We’re excited to bring you a closer look at the latest findings. Every year we intend to capture the pulse of the industry—from small local businesses to large-scale operators—and this year’s results tell a compelling story. Let’s dive deeper into what’s shaping the civil construction sector right now.

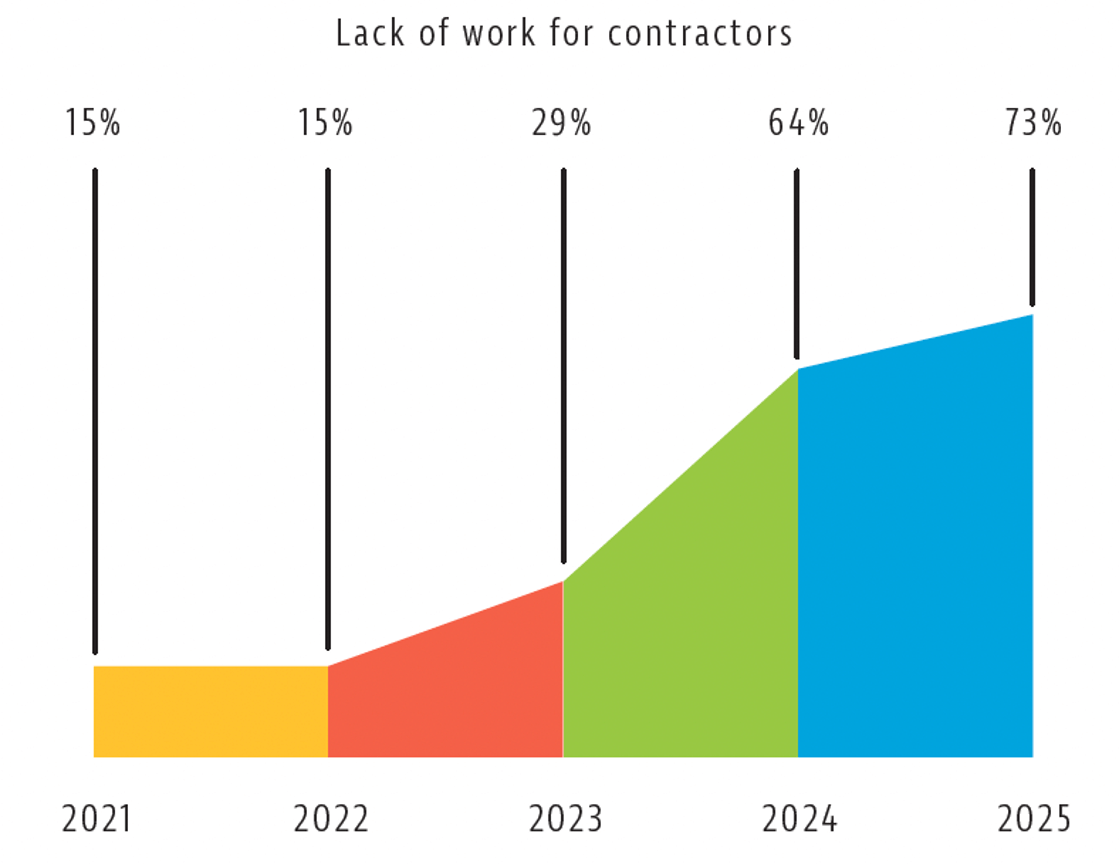

1. Work Availability is Tightening: 73% Citing Lack of Work

The report reveals a significant increase in contractors feeling the squeeze, with 73% citing a lack of work as a major challenge, up from 15% since 2021. This shows a confidence crisis where a lack of work and uncertainty is placing the long-term health of the industry at risk. The hope? The National Infrastructure Pipeline now shows planned future projects (totally $207b), but there’s a significant difference between projections and projects reaching market.

For contractors, this may mean more competition for fewer jobs and tighter margins. Smaller operators, who make up 60% of the space, are feeling this crunch as 27% have revealed they are expecting a revenue reduction, triple the volume since the 2021 survey.

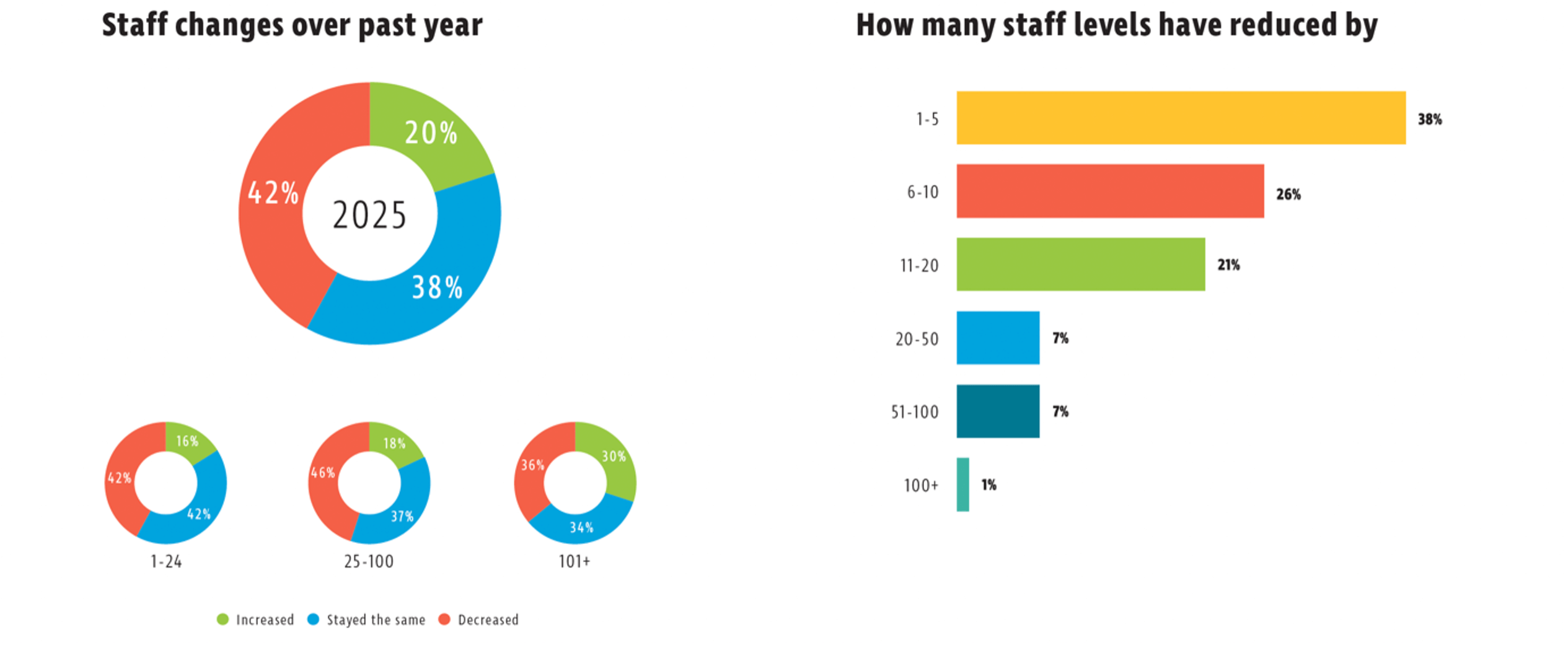

2. Labour Market Softening: 42% Decreasing Staff Numbers

While a fifth (20%) showed signs of increasing staff, more have indicated they have reduced numbers. 42% of respondents reported reducing staff numbers over the past year, reflecting insight on fewer projects, cost-cutting measures and lack of work.

After a softening in labour demand over the last 4 years, we have seen little uplift since 2024. Half of businesses expect requirement for staff to stay the same. 28% of businesses state that no recruitment is needed.

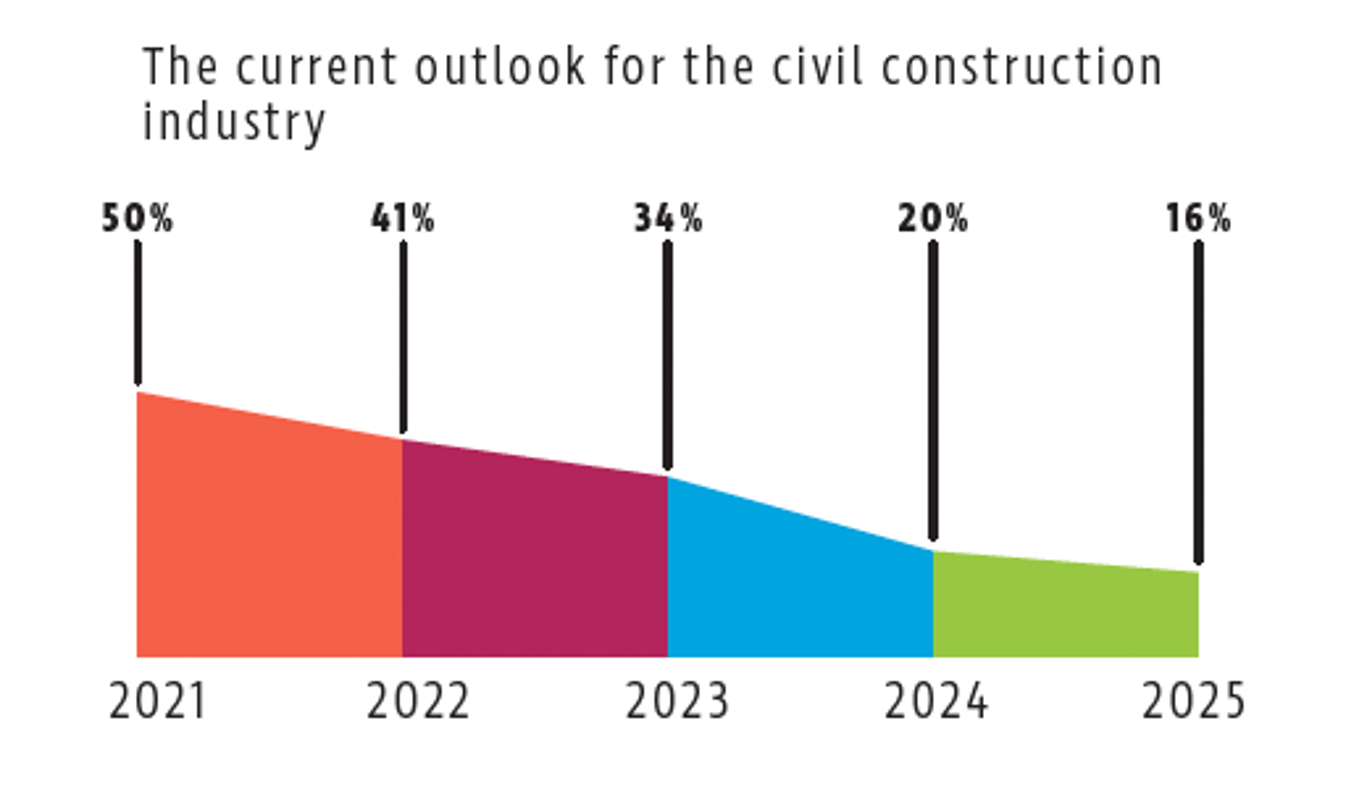

3. Confidence Declines Sharply: Positive Outlook Drops from 50% to 16%

Confidence in the industry’s near-term prospects has taken a marked hit. In 2021, half of respondents had a positive outlook, but now only 16% feel optimistic about the current state of the civil construction sector.

"It’s never been more important for central and local government to step up with a clearer, more consistent and visible pipeline of infrastructure construction and maintenance work, rather than just announcements," said Alan Pollard, Civil Contractors New Zealand Chief Executive. "We see this playing a central role in strengthening business confidence, helping to keep skilled workers in the industry, and ensuring we’re ready to meet not just today’s needs, but also New Zealand’s future infrastructure needs."

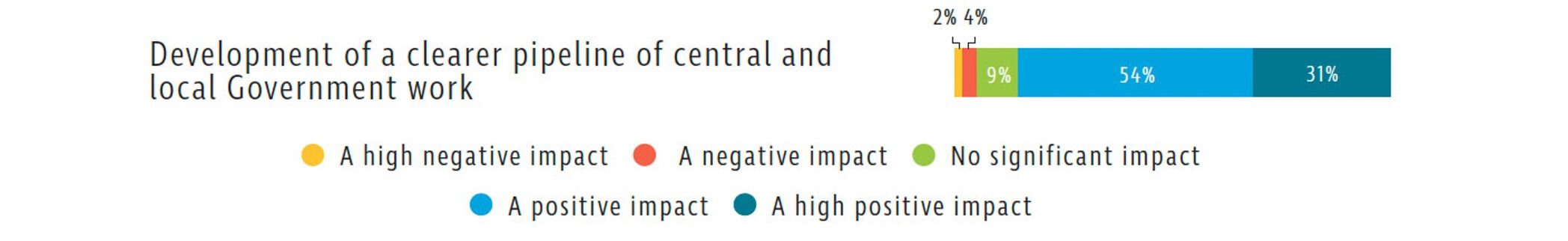

4. The Power of a Clear Pipeline: 85% See Positive Impact from Transparent Government Work

One of the clearest messages from the survey is that 85% of respondents believe a clearer and more predictable pipeline of central and local government projects would significantly improve business confidence and financial stability to help the industry regain its footing.

The verbatim from respondents shows strong confidence in transparency and certainty for a long-term pipeline to better plan for the future:

"Depoliticise infrastructure and create 30 year+ pipelines so businesses and local government can plan and be sustainable."

"Effective management of longer-term work pipelines without the frequent changes and stops and starts that occur. Planning to ensure that investment is spread evenly over time to minimize ups and downs."

"Continuity between successive governments. Accountability to deliver pipeline of projects."

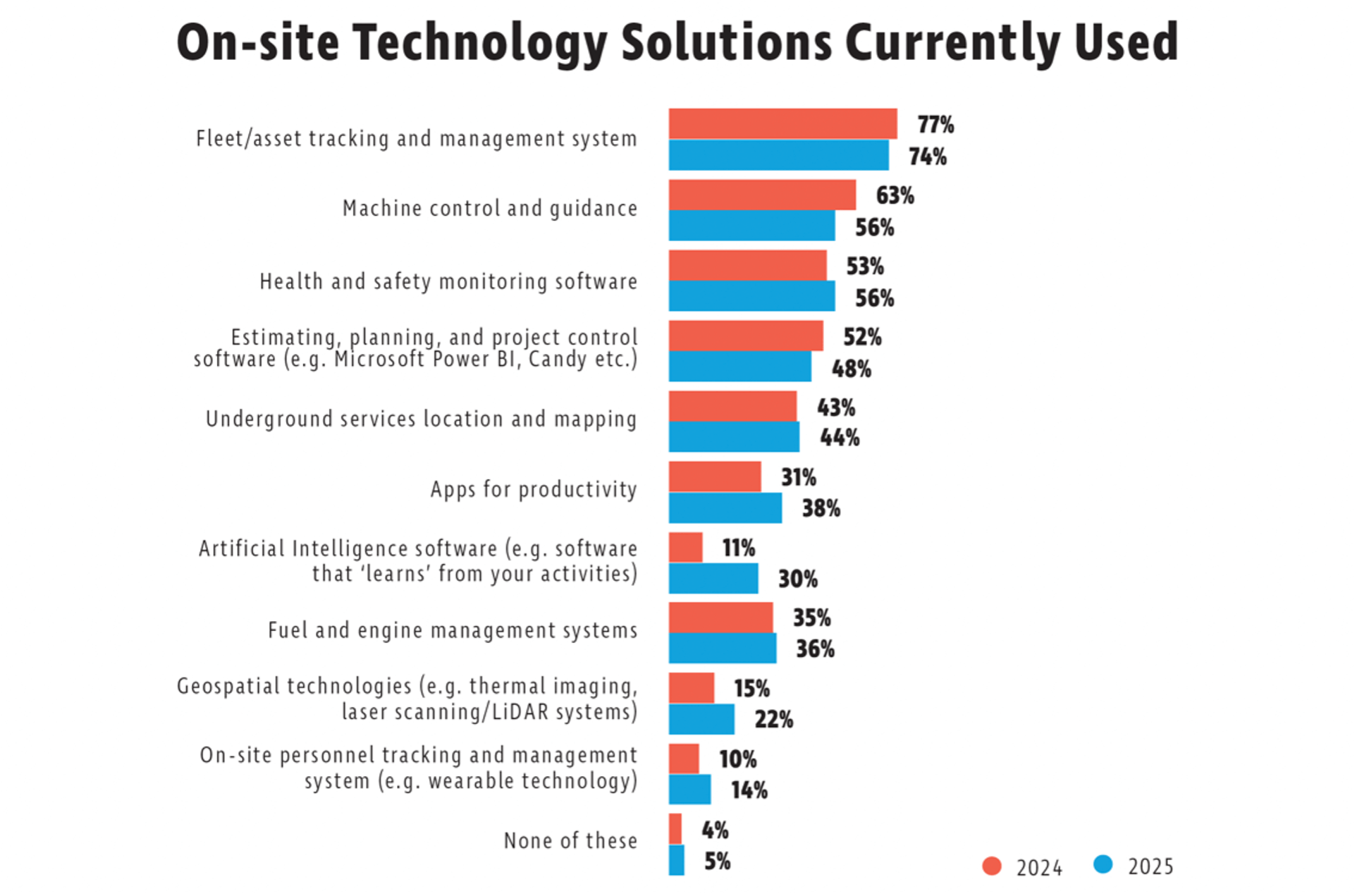

5. Technology is recognised as a strategy for business efficiency and growth

Research also revealed technology’s positive role in the sector’s business outlook, with more than 40% of civil construction professionals seeing technology to improve business efficiency and overcome challenges. Using technology strategically offers a competitive advantage to secure future projects, with 60% highlighting onsite tech to win work.

"While confidence in the sector is under pressure, our research with CCNZ clearly shows that businesses that embrace digital tools and connected platforms are positioning themselves to win work and navigate today’s industry uncertainty," said James French, Construction Industry Specialist ANZ from Teletrac Navman.

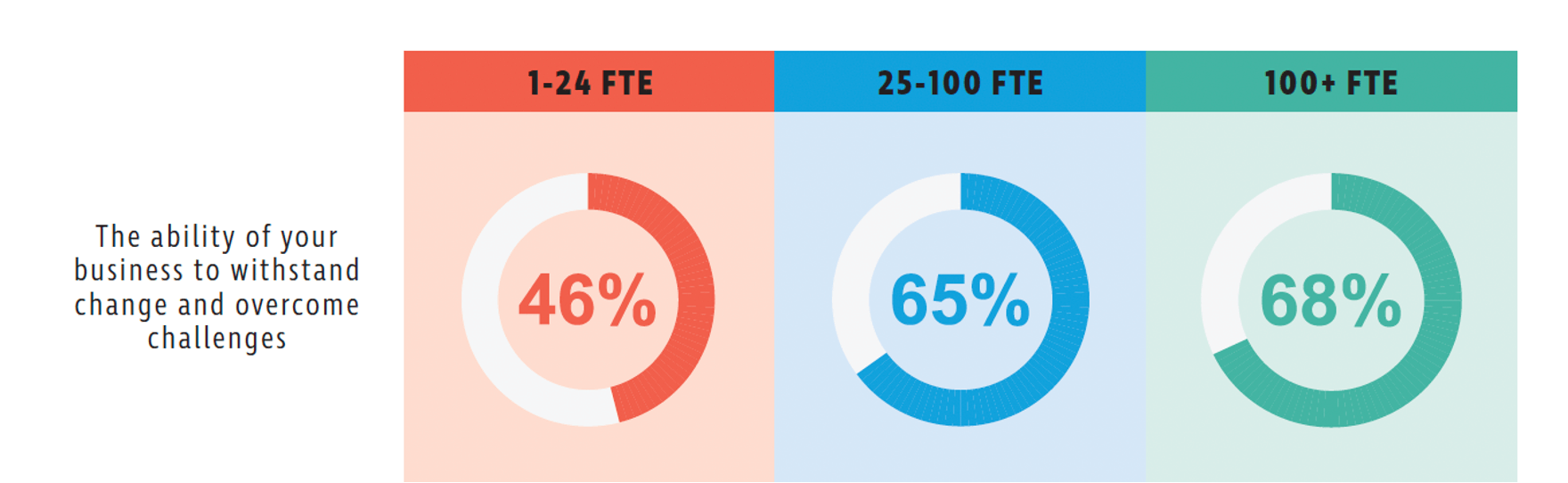

6. Small and Medium Businesses Feeling Less Confident: Only 46% Feel Ready for Change

Small and medium-sized businesses are the backbone of the civil construction industry but are currently feeling the most pressure. Less than half (46%) express confidence in their ability to withstand change and overcome industry challenges.

Furthermore, small and medium businesses also responded that:

- 83% not confident in the Government’s commitment to infrastructure

- 86% not confident in the current outlook for the civil construction industry

- 88% not confident in the ability of New Zealand's infrastructure to cope with climate change

- Less than half (46%) confident in the ability of their business to withstand change and overcome challenges

This insight highlights the need for tailored support, training, and policies that help smaller operators build resilience and adaptability in a rapidly evolving market.

Wrapping Up: Resilience Amidst Challenges

The 2025 report paints a picture of an industry that is undeniably resilient but grappling with significant headwinds—contractors face less work, shrinking teams, and falling confidence. Yet, there’s opportunity in the form of clearer government pipelines and the strategic use of technology.

As we continue to support New Zealand’s civil construction sector, these insights guide us toward where efforts can make the biggest difference—whether that’s advocating for transparent project planning, helping SMBs adapt, or demystifying technology adoption.

Want to explore the full story? Check out the full report and press release here:

Thanks for being part of this journey with us! Stay tuned for more insights and practical support as we work together to build a stronger, smarter civil construction industry.